In our fast-paced modern world, it seems like we're always juggling a steady stream of monthly financial responsibilities. Whether it's rent or mortgage, utility bills, car loans, and other essential expenses, managing our finances can feel like an endless task.

Introducing CardUp, the platform that allows you to earn credit card rewards on non-card expenses - helping you earn rewards faster! Let's discover how our platform can transform your everyday expenses into thrilling opportunities for savings and adventure.

An alternative holiday savings tool

Christine is an avid traveler with an insatiable wanderlust, and her sights are set on Tokyo, Japan. However, she found herself facing the age-old dilemma – how to earn miles faster without drastically changing her spending habits.

Want to view the infographic instead of reading? Click here.

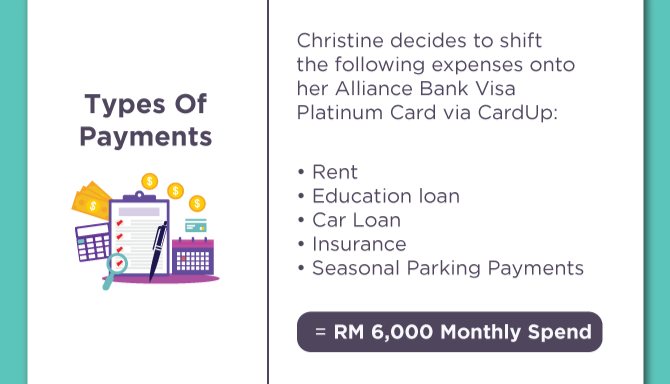

That's when she stumbled upon a game-changer that would soon become the catalyst for her journey to Tokyo, all while making her non-card expenses work in her favour. She realised she could earn miles faster than ever by using CardUp to pay her big monthly bills - let's look at what she has:

She has been consistently cashing out RM6,000 each month from her bank, missing out on the credit card rewards she rightfully deserves.

What makes it incredibly simple for her to embark on her CardUp journey is that her payment recipients aren't required to be CardUp users themselves. All she needs to do is charge these payments to her credit card, and CardUp will efficiently transfer the funds to her recipients via bank transfer.

Maximising credit card benefits

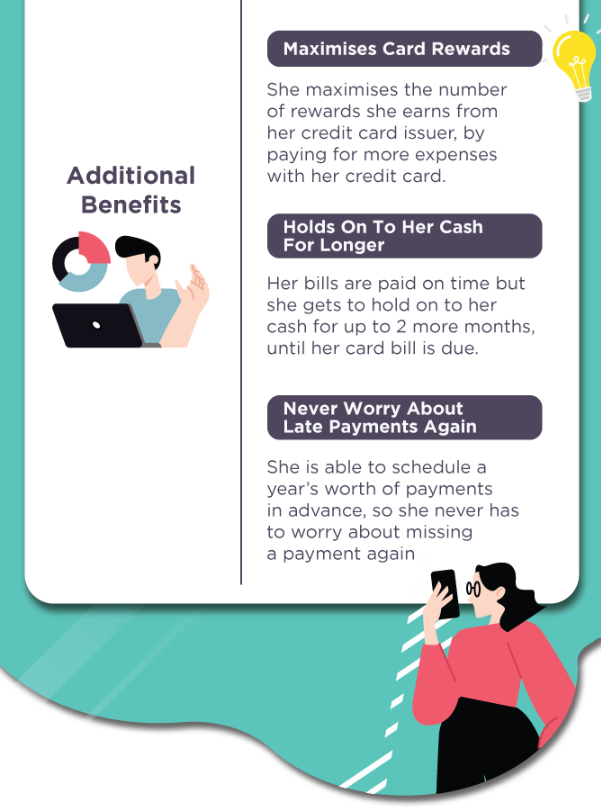

By shifting all these large expenses to her credit card via CardUp, Christine also enjoys additional benefits that her card provides and lifts the weight of immediate financial stress off her shoulders.

What did she get in return?

With her RM72,000 annual spend, she is rewarded with over 58,500 air miles - and it's time for Christine's vacation to Tokyo, Japan!

This means Christine's able to save RM2,200 (a whopping 66% saving!) on her flight ticket, and she still has over 2,000 air miles left for her next exciting journey!

CardUp charges a small processing fee to enable you to earn rewards on expenses that typically don’t accept credit cards. The rewards earned can easily outweigh the fee, which is why Christine gets to enjoy a 66% off her flight cost by redeeming the air miles earned from the payments she made on CardUp.

What's more? to enjoy more savings, Christine introduces CardUp to all her friends through the CardUp Referral Programme, to enjoy payments on CardUp with ZERO processing fees.

Don't get left behind

Whether you want to travel around the world or are simply looking to maximise your credit card rewards, CardUp is here to help you unlock the benefits of your credit card. You can now shift your large or recurring expenses onto your existing credit card using CardUp. This includes expenses that traditionally couldn’t be paid by card, or where rewards couldn’t be earned.

Need to make these payments?

Why not shift it to CardUp? It's time to unlock the full potential of your credit card rewards and treat yourself to an epic travel adventure - you've earned it!

You can use CardUp’s rewards calculator to quickly assess how many miles you can earn, the fees involved, and the potential savings for these anticipated expenses.

Want to get a fee waiver on your first payment?

Complete the form below and we will send you the promo code to get started

View full infographic

This article is originally published in RinggitPlus.com